Price: $39.95

(as of Apr 11, 2024 03:50:51 UTC – Details)

Product Description

Electronic Filing

Multiple Entities & Manage Staff

Multiple Entities & Manage Staff

TFA let you add several business and mange them, if you have too many clients that’s a good problem to have and we have a perfect solution, you can add staff and assign businesses to them so they can help your growing business.

e-File W2 & 1099 Tax Form From Made Easy

Using Window, Mac, or Online From the Browser

Business owners and CPAs shouldn’t have to be tech savvies to use file service, we designed our tax e-file software to looks like your are paper filing, all the technologies and complications moved to back where it should for tech professionals not the tax advisors.

Tax File App is designed to update every year automatically so you don’t have to purchased again or import you information, you can also file previous years so you don’t wander on the internet and find a software for that.

Simplified & User Friendly Interfaces. Auto Update Every Year, No Need To Purchase Next Year. File For Past Years. Secure and Reliable.

eFile 1099 Software for Mac & Windows

With Tax File App, yo have the freedom to install it on Max or Windows computers, it’ s also available online if you prefer not to use a software or if you decide top computer at work and web browser at home, we store your information in secure cloud computing servers for fast and high availability so all your filing information will be synched securely no matter what platform you are using.

Add Unlimited Businesses, Free Of Charge

TFA e-file software is not only for business owners, it’s designed to fit CPAs need to add unlimited clients or entities, and for tax agencies you can add staff and assign each staff member one or more clients to organize the work flow.

Unlike others that charge annually for adding limited entities, we made it unlimited and free.

Generate Copies and Summary Form.. Yes, it’s Free

Generate 1096 Summary Form with recipient, payer, payer state, and state reconciliation copies for free, all you have to do is after e-file a form, click on generate copies, the process will take few minutes and you will get an email notification when it’s ready to download.

Top Security Protocols

We have firm protocols in place for safeguarding our clients’ and recipients’ data. All data, including Personal Identifiable Information (PII) is encrypted and stored in a secure HIPPA Compliant server. In addition to that you can easily add another layer of security to your account with multi-factor authentication.

Windows & Mac

Unlimited Business

Generate Copies

Secure & Reliable

Previous Years Filing

Tax File App support filing for the last two years (2022 & 2021) for now, in the feature more years will be supported.

QuickBooks Integrations

QuickBooks and Xero accounting software integrations feature is available to avoid manual data entry by offering the users a way to quickly cross-reference their 1099 reports before transmitting their returns directly to the IRS.

The most affordable with intuitive interface for small businesses and tax professionals to file w2, 1099 tax forms.

Windows and Mac compatible with online access and secure cloud storage to store the filers information to access it every year from any devide with online access.

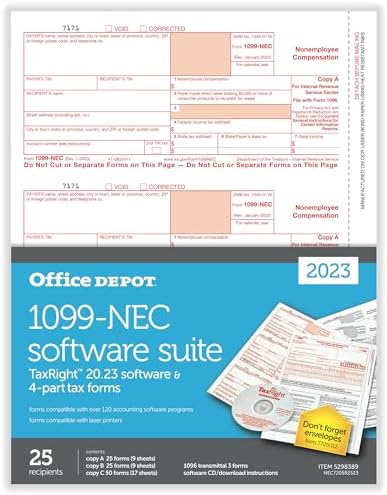

The software support W2, 1099-MISC, 1099-NEC, DIV, INT, B, C, R, S, K, T, G, PATR, SA, OID, Q, 1098, 1098-T, W-3, and 5498 series.

Distribute form copies via Online Access, Postal Mailing, or Print with blank papers.

Import tax information from QuickBooks, Xero, or in bulk using Excel and CSV files.